Signs Point To Rise In CAD vs. USD

October 16, 2019 – Source: Seeking Alpha – Back in August, the argument was made that while the Canadian dollar could see potential upside against the greenback over the longer term, the CAD/USD is likely to trade stationary for the time being.

This has more or less been the case in the past two months, as can be viewed here:

One of the big reasons behind the CAD/USD having made gains earlier in the year was anticipation of a renewed NAFTA agreement with the United States and Mexico. Given Canada’s dependence on exports – particularly to the United States – this development saw the loonie gain significantly against the dollar.

That being said, this does not include the steel and aluminium tariffs that were previously imposed on Canada, and these still need to be dealt with in their own right. In this regard, while agreement of a deal did give a short-term boost to the Canadian dollar, the CAD/USD still remains significantly below levels seen back in August.

That said, the Bank of Canada is somewhat of an anomaly among its peers at this point in time, in that the bank is not moving to cut interest rates to spur economic growth – as has been the policy of the ECB and Federal Reserve. With wholesale trade in Canada having risen by 1.7% in July due to stronger motor vehicles, personal and household goods – the economic rationale for a rate cut is not particularly pronounced at this point in time.

Moreover, with recent attacks on Saudi and Iranian oil infrastructure having induced concerns regarding supply in the markets – Canadian crude exports could stand to benefit significantly given the country’s proximity to the United States. In turn, this will likely fuel further demand for the loonie.

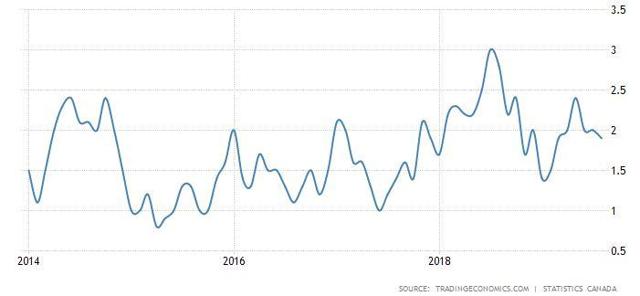

Additionally, the inflation rate in Canada currently stands at 1.9%. This is slightly higher than the 1.70% in the United States, and 1.40% in the European Union.

Canada is under significantly less pressure to drop interest rates in order to boost inflation – and for this reason, the view is that the loonie will strengthen from here.

While the CAD/USD has seen a depreciation in the past couple of months, the fundamentals of Canada’s economy continue to remain sound, and I take the view that we could see a rebound in CAD/USD to the prior August high of above 0.76 by the end of this year.